Nexus: The First Platform to Align Risk, Research and Performance for Fundamental Investors

Make Risk-Aware Decisions Without Compromising Your Investment Philosophy

Fundamental investors excel at identifying opportunities—but integrating risk insights, price targets, and investment views into portfolio decisions efficiently can often be a challenge.

That’s why we built Nexus—in collaboration with multi-managers, asset managers, and hedge funds who needed a better way to align their investment thinking with execution.

With Nexus, you can seamlessly:

- Analyze the current state of your portfolio including what is driving volatility, risk exposures, expected returns, performance data in real time.

- Integrate internal research, price targets, fundamental insights, and risk awareness into portfolio decisions.

- Optimize portfolios based on your objectives and constraints with or without a factor model.

Take Control of Your Portfolio Today

Ready to experience Nexus? Let’s talk.

Why Nexus?

-

360° Risk Visibility – Understand idiosyncratic and factor risk alongside expected returns and performance drivers. - Seamless Research Integration – Connect investment theses, price targets, and internal research directly to your portfolio logic.

- Real-Time Trade Simulation & Optimization – Run live simulations and optimizations based on your new insight. Understand how these changes would impact your portfolio and create trade lists.

- Create Hedging Baskets or Leverage Existing Baskets – Create baskets or use baskets you subscribe to hedge factor risk for individual securities or for the entire portfolio. Make dynamic changes that reflect both risk and research views.

See Nexus in Action

Gain Portfolio Transparency & Insights

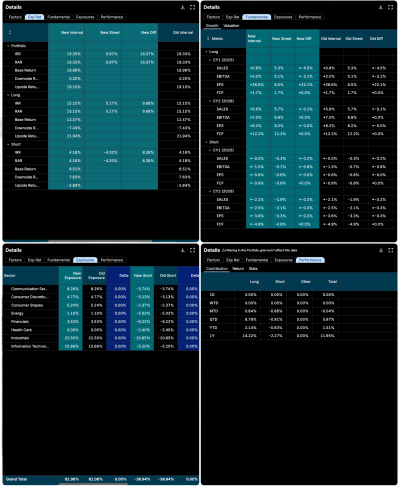

Break down key risk drivers, factor exposures, and return attribution—so you know exactly what’s driving performance—both on the portfolio level and on the manager level.

Enhance Portfolio Construction with Real-Time Trade Simulation and Optimization

Set objectives and constraints, instantly simulate trades, and leverage Sharpe ratio insights, fundamental research, and factor-aware analytics to capture opportunities and minimize risk.

Refine Your Portfolio with Confidence

Leverage insight to create trade lists that take into consideration risk exposure, return expectations, and performance.

Explore More

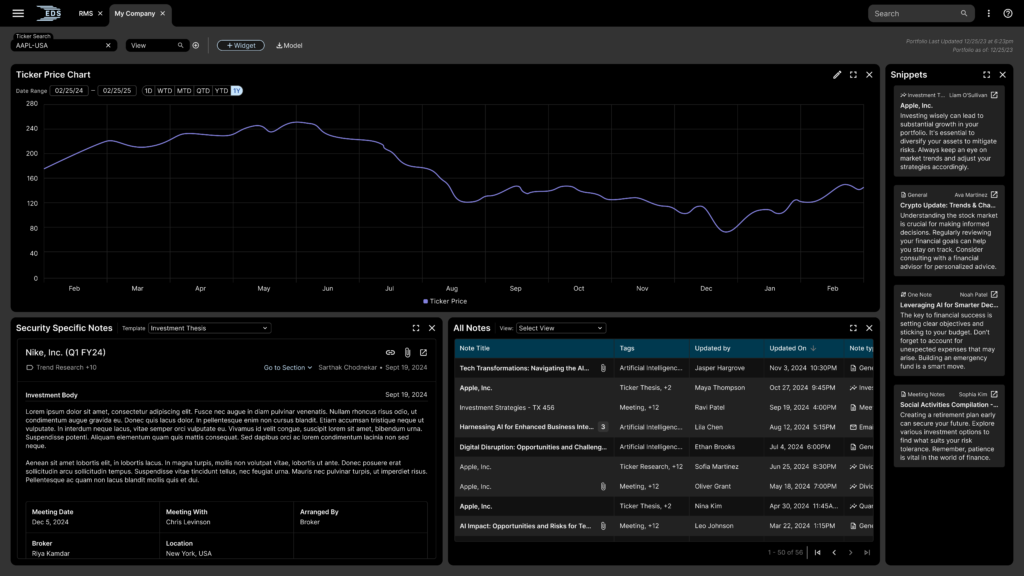

My Company

A company-level, configurable dashboard that brings together quantitative and qualitative data across your investment universe. Customize views to track price target changes, valuation metrics, investment theses, deviation vs. the Street, sizing and P&L, factor risk, and more. Overlay price target scenarios on interactive charts and monitor real-time changes—all in one place.

My Portfolio

A portfolio-level, configurable dashboard designed for performance attribution and risk analysis for a single portfolio or across multi-manager and multi-strategy portfolios. My Portfolio works alongside Nexus as a dynamic reporting tool, with automated delivery options—helping you stay informed, supports marketing and IR efforts, and present clear, data-driven insights to investors and LPs.