TLDR: Since COVID, factors have become an integral part of the equity investment landscape. Both fundamental and macro factors have played an outsized role in 2025, and EDS allows you to explore both. Popular fundamental factors have unraveled and provide less immediate guidance. Macro conditions have become tentative with stagflation concerns. We can observe when and how much macro conditions changed the environment in which equity sectors must operate. As U.S. policy has shifted at an unprecedented speed, winning sectors have flipflopped. Now the macro environment supports defensive versus cyclical. Macro factors pinpoint which sectors are most influenced by which macro drivers on a go-forward basis.

Factor Fiascos 2025

Investors ignore factors at their own peril. Factor rotations are large and permanent features of modern markets. EDS strives to help investors with factor transition through our partnerships with leading equity factor model and macro factor model providers.

In 2024, Beta, Momentum, and Residual Volatility (thematic trades) were the winning trades and reversed as a source of investor indigestion in 2025. Even before the beginning of the year drops, these factors stalled since Dec 2024. Beta has continued falling off the cliff and with the 2024 unwind almost done (see below).

As fundamental factors are rangebound and unwound, we need to look elsewhere for clarity. We can turn to macro for a better understanding of market risk and behaviors.

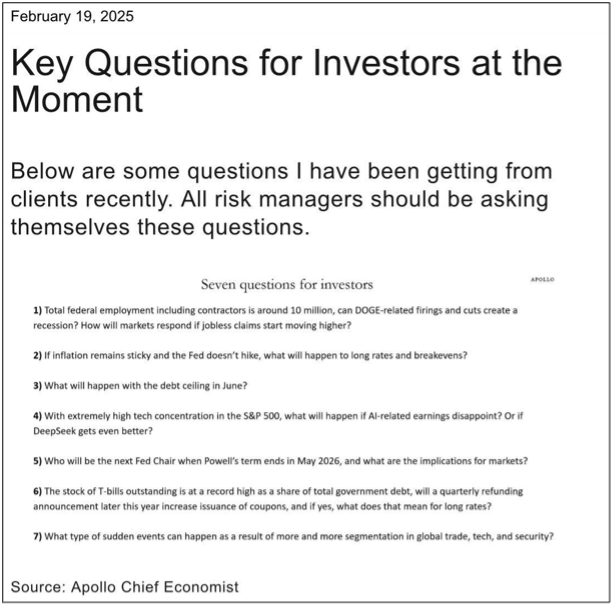

Macro meltdowns, large and small, are top of investors’ minds. Torsten Slok, Apollo Chief Economist, has highlighted macro as the source of greatest uncertainty this year. His note highlights inflation, real rates, rate expectations, and fiscal missteps (see below).

All equity portfolios contain exposures to these different macro levers. Would you want to know your portfolio’s macro exposures and whether the factors were propellers or drags?

Equity teams will continue to do what they do best, focusing on company-specific fundamentals. But gaining macro clarity will help better manage portfolios. What investors need is the right macro lens to assess macro impact on their names and their investable markets.

Measuring Macro Factors

To answer these questions for investors, EDS has partnered with Quant Insight (QI), a leading provider of macro factor models (MFERM). With an approach grounded in theory and the latest technology, QI has built MFERM to answer these 3 questions:

- Does macro matter for me?

- If so, which macro exposures?

- Am I being compensated for taking that macro risk?

MFERM provides factor exposures, return and risk attribution like typical risk models.

MFERM decomposes returns into how much came from the changes in growth expectations (GDP Nowcast, Copper, WTI, etc.), financial conditions (USD TWI, HY credit spreads, real rates, etc.) and risk appetite (VIX).

The Inauguration of Macro – The Trump Bump

In the beginning of the year, President Trump was wildly seen as net positive for equities. With MFERM, on Jan 17, 2025, clients of EDS and QI were able to precisely answer if they were compensated to take on macro risk by analyzing the S&P 500 YTD sector returns.

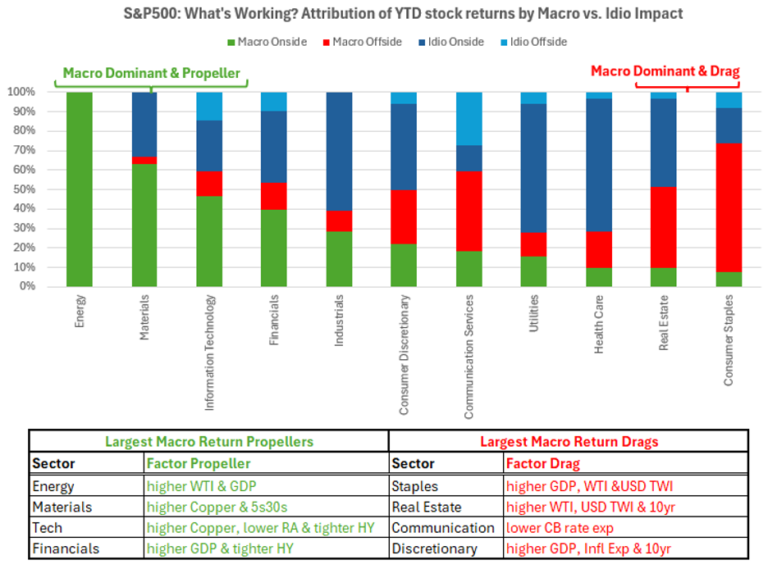

Through this lens, we can discern which sectors were most supported and least supported by macro and which were idiosyncratic (independent of macro).

- Where had macro been most supportive? Energy, Materials, Tech, and Financials. Overall, this group were reflation beneficiaries – benefiting from higher GDP growth, copper, etc.

- Where had macro been least supportive? Staples, Real Estate, Communication Services, and Consumer Discretionary. For this cohort, good news was bad news. This group is more sensitive to Financial Conditions, not wanting to see higher rates / a stronger dollar-based relationship.

- Where were idiosyncratic factors most important? Utilities, Healthcare, Consumer Discretionary, and Industrials. Perhaps no surprise for utilities, considering the secular theme around AI data center / power needs. Consumer Discretionary was driven by a strong spending in price insensitive groups.

These observations were extracted from the chart below, which shows what % of stocks in each sector fell into macro/idio onside and offside:

- Macro onside vs. offside: In the chart below, a large green bar means macro has been additive to returns (macro onside). Conversely, a large red bar means macro has been a drag on returns (macro offside).

- Idio onside vs. offside: A large dark blue bar means idio has been a major driver of returns (idio onside). Idio offside is least important.

Macro Footprint of The Trump Slump

The market party ended as the Trump bump shifted with the economic reality of the administration’s new policies. As mentioned, Beta and Momentum turned down.

Since mid-Feb, CDX HY credit spreads have widened, VIX has risen, commodities have fallen and the GDP Nowcast has fallen. Couple this with record-high policy uncertainty alongside inflation expectations closer to 3% than 2%. The result is a deterioration in the growth / inflation trade-off which will remain front and center in H1 2025.

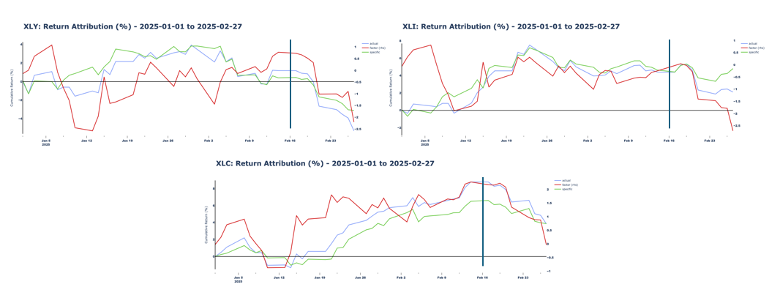

This is being reflected in greater macro factor support for defensive relative to cyclical sectors. The charts below show a shift in the macro environment, starting around Feb 16 (marked by a vertical bar), about 5 trading days before the general market decline set in. The total return is the blue trace, macro factor return is the red trace, and specific return is the green trace. (Charts sourced from EDS and Quant Insight)

From a macro perspective, some of the most challenged sectors have become market stalwarts in recent weeks. Staples and Real Estate start the year underperforming but have been recently lifted by macro. Healthcare has had a strong bid all year and now has macro tailwinds as well. Utilities have sold off due to idiosyncratic AI concerns, but macro has been additive.

Energy, Financial, Technology, and Materials saw a boost from macro initially in 2025. Now macro is a deadweight pulling all but the Financial sector down. If financial conditions worsen, the macro factor signature points to a potentially large drop in financials.

As mentioned in the inauguration of macro section, Communications and Consumer Discretionary continue to be dragged by macro. Higher Central Bank rate expectations weighed on Communications (underperformance was compounded by a momentum/beta decline). Consumer Discretionary suffers from valuation concerns in a higher inflation environment. Industrials were behaving largely independent of macro. Now growth concerns have weighed on Industrials.

What is Next?

While returns are backward looking, we can forecast macro volatility for sectors using QI’s macro lens. Volatility forecasts tell us what could drive future returns, whether down or up.

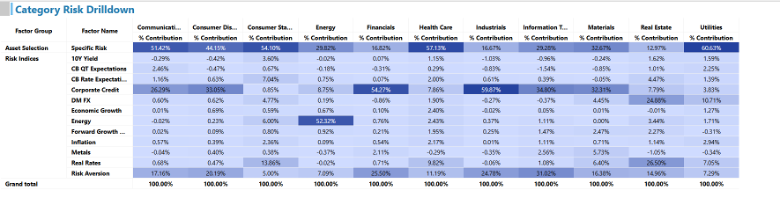

The dominance of corporate credit and risk aversion reflect their close relationship with the market itself. The main takeaways at a sector level:

- If you are focused on macro volatility, factor vol as % of total vol is highest in Communications (XLC), Consumer Discretionary (XLY), and Utilities (XLU). Macro volatility is also high for Healthcare (XLV), and Staples (XLP) as these serve as defensive.

- If you are focused on credit conditions, the credit cycle matters most for risk in Industrials (XLI), Consumer Discretionary (XLY), Communications (XLK), and Financials (XLF).

- In an unexpected risk off event (think Deep Sink, Tariff policy), a risk-off shock will matter most for risk in Financials (XLF), Industrials (XLI), Technology (XLK) and Consumer Discretionary (XLY).

- If you are focused on dollar volatility, hedge Real Estate.

- If you are focused on softening economic growth, Consumer Discretionary carries the highest risk.

- Traditional relationships in commodity and real estate still apply: Real rates matter most for Real Estate (XLRE) risk, metals matter most for Materials (XLB) risk, and WTI (labeled as Energy) highest for Energy risk.

Depending on your investment vision, understanding both fundamental and macro factors can be crucial for investment success. Factor rotations, policy shifts, and macroeconomic volatility demand a comprehensive approach that integrates both datasets. With EDS and our partnership with Quant Insight, investors can seamlessly analyze how macro conditions impact equity portfolios, identify sector-specific risks and opportunities, and make informed decisions with greater confidence. As macro uncertainty continues to shape the investment environment, leveraging the right tools to measure and interpret these influences will be key to staying ahead. By using EDS, investors gain a powerful macro lens to complement their fundamental analysis, ensuring a more holistic and adaptive investment strategy.