Introduction

In a recent webinar co-hosted by MSCI and EDS, industry experts gathered to explore how investment managers can turn market turbulence into opportunity.

The session featured distinguished speakers Mark Carver, Managing Director at MSCI; Sandeep Varma, Co-Founder and CEO at EDS; and Benjamin Lieblich, Chief Data Scientist at EDS.

They provided invaluable insights into current market conditions, the role of factor investing, and how advanced platforms can help fund managers capitalize on opportunities during volatile times.

Below, we highlight some key takeaways.

Turning Market Turbulence Into Opportunity

At the heart of the webinar was a discussion on the current state of global markets and how investors can navigate periods of uncertainty. The panel highlighted that while market volatility can be a risk, it also presents opportunities for those who are prepared and understand the factors influencing market movements.

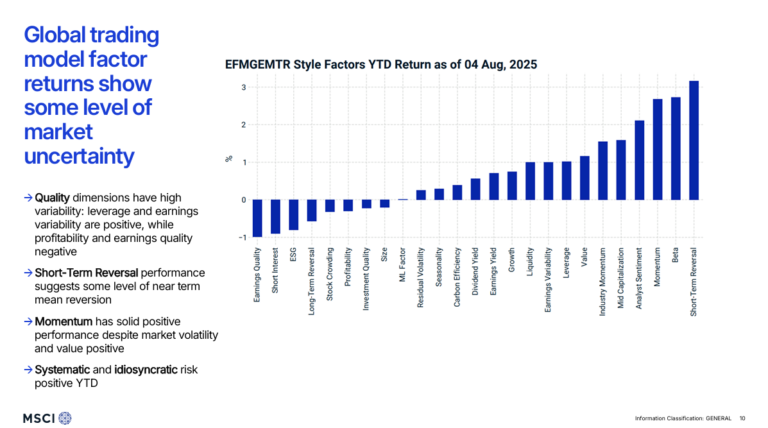

Mark Carver from MSCI shared some compelling insights on how market uncertainty often results in divergence in factor performance, especially when contrasting different markets like the U.S. and Europe. Investors need to be aware of the macro drivers, including central bank policies and global trade dynamics, that influence market movements.

With factors like momentum, value, and short-term reversal showing diverse performances across regions, understanding these market signals is key to transforming potential risks into profitable opportunities.

Leveraging Factor Analysis for Smarter Investment Decisions

One of the standout features of the webinar was Sandeep Varma’s deep dive into how investors can use factor analysis to guide their investment decisions, especially during turbulent times. Through EDS’s Nexus platform, fund managers can understand their portfolios’ factor exposures and align them with their desired risk profiles.

For example, Sandeep demonstrated how managers can use factor models to track short-term reversals and how they often signal market uncertainty. These types of models are essential for active managers who want to capitalize on market inefficiencies, especially when factors like momentum and value behave unexpectedly.

In addition, Sandeep showcased how the platform enables investors to track idiosyncratic risk—the stock-specific risk—by breaking down individual exposures, giving them the ability to take advantage of mispriced securities.

AI-Powered Tools for Risk Management and Optimization

Benjamin Lieblich presented how AI-driven analytics within EDS’s platform can provide real-time insights into portfolio performance and risk decomposition. With AI-backed research tools, fund managers can optimize factor exposures in real time, making adjustments as market conditions shift.

A powerful feature demonstrated was the AI-based research assistant. This tool leverages both qualitative and quantitative data to analyze stock-specific strategies and predict future price movements. This AI-enhanced decision-making capability helps managers stay ahead of market shifts and mitigate potential risks by providing data-backed guidance on hedging or adjusting positions.

Key Insights from the Webinar

• Factor Investing: A powerful strategy during periods of market uncertainty, helping investors understand and manage exposures to momentum, value, and other key factors that drive market returns.

• AI and Data Integration: AI tools that integrate internal research data, such as earnings reports or strategy notes, can provide investors with timely insights into how to adjust portfolios for risk and return optimization.

• Market Divergence: Understanding the divergence in factor performance between different markets—such as the U.S. versus Europe—can create opportunities for global diversification.

• Hedging with Baskets: For investors looking to hedge specific factors, EDS’s platform allows managers to apply tailored hedging strategies, ensuring their portfolios stay aligned with market opportunities while controlling for excessive risks.

Watch the Replay to Dive Deeper

Curious to see how these strategies and tools can transform your investment approach? Reach out and we’ll send you the full “Transform Market Turbulence into Opportunity” webinar to discover the actionable insights shared by Mark Carver, Sandeep Varma, and Benjamin Lieblich.

Conclusion

Navigating market turbulence requires not just awareness of macroeconomic trends but also the tools to act decisively. Whether it’s understanding factor performance or using AI-powered platforms for real-time risk management, the right insights can turn uncertain markets into opportunities.

Don’t miss out on the chance to refine your investment strategy and overcome market inefficiencies.