The Big "I" Analyzes Artificial Intelligence

To analyze AI technologies, Sam Levenson, Chief Executive Officer of Arbor Advisory Group, moderated a panel discussion on technology tools. Panelists included Evan Schnidman, Ph.D., Founder of EAS Innovation Consulting; Greg McCall, Co-Founder, President & CFO at Equity Data Science; and Dan Romito, AVP, Business Development & IR Product Strategy at Nasdaq.

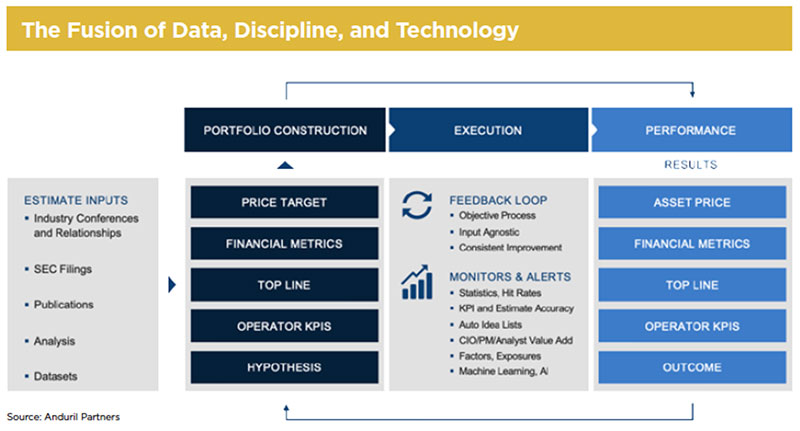

McCall identified several questions that investors typically ask, which he noted are largely the same questions that IROs ask regarding their stock. They question what trends are driving the stock, what KPIs influence valuation, what peer group is relevant to the stock, and more. AI tools offer innovative ways to answer these questions.

Source: Excerpts from IR UPDATE: Fall 2020 Magazine

Are You Using The Right Answers?

Please contact EDS at sales@equitydatascience.com for more information.